Have you purchased an investment property, a second property, a multiple dwelling, mixed use property or a property within your pension scheme?

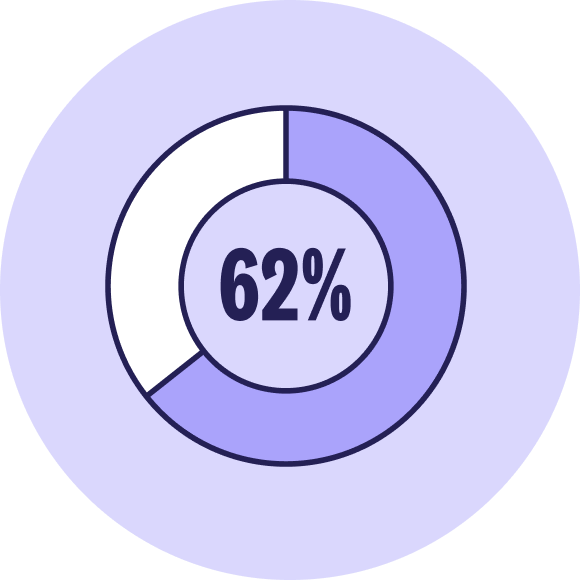

The chances are if you did purchase any of the above, that you were not correctly advised in relation to the amount of Stamp Duty you should have paid on the transaction. Stamp Duty legislation is complicated and contains over 40 different reliefs. Conveyancers and agents are often not aware of, or fully consider, the relief details. Typically they rely on the HMRC tax calculator which is overly simplified and quickly available. In addition, some relief may be claimed retrospectively.

We at Claims Supermarket can review the transaction for free, and if we consider you have overpaid Stamp Duty, we can seek to recover any amounts on a no win no fee basis. Unlike other firms, we are a professional, nationwide law firm, and we use qualified tax advisors on each case to ensure we only take cases forward with a strong chance of success.