At Claims Supermarket, we understand that falling victim to a scam can happen to anyone. Here are some of the most common types of scams we help people with:

Invoice and mandate scam: This happens when you try to pay an invoice to a legitimate payee, but the scammer intercepts and changes the payment details, tricking you into sending money to them instead.

CEO fraud: In this case, the scammer impersonates a high-ranking official from an organisation, such as the CEO, and convinces you to make a payment to a fraudulent account.

Police or bank impersonation scam: Criminals may contact you, pretending to be from the police or your bank, and pressure you into transferring funds for supposed security reasons.

Family or friend impersonation scam: Scammers may pose as a family member or friend, often claiming to be in an emergency situation, and ask you to send money to help them.

Purchase scam: If you’ve paid for goods or services that never arrive, you may have fallen victim to a purchase scam.

Investment scam: Fraudsters may convince you to move your money into a non-existent fund or fake investment opportunity, promising high returns but ultimately stealing your money.

Romance scam: Criminals create fake profiles on social media or dating websites to build a relationship with you, then manipulate you into sending them money.

Advance fee scam: In this scam, criminals convince you to pay a fee upfront, claiming it will lead to a larger payment or valuable goods, but you receive nothing in return.

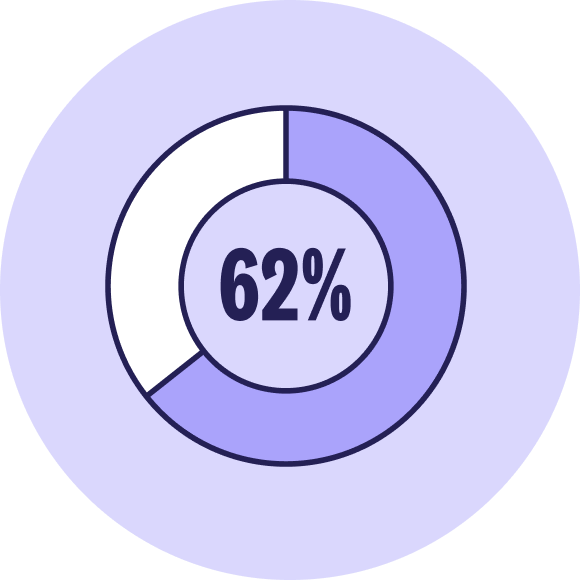

If any of these situations sound familiar, and you’ve lost £3,500 or more, Claims Supermarket is here to help. Our experienced team will work tirelessly to reclaim your money without making your life more stressful.